Mental models are powerful tools for investors to help them understand the world and make informed investment decisions. Mental models are frameworks for understanding complex concepts and phenomena, and they can be applied to various aspects of investing, such as stock picking, market analysis, risk management, and portfolio construction.

One of the benefits of mental models is that they help investors avoid biases and irrational thinking, and instead make decisions based on a structured and logical approach. In this blog post, we’ll take a look at some of the most useful mental models for investing and how they can help you improve your investment decisions.

Here are some important mental models for investing:

The Power of Compound Interest: Compound interest is one of the most fundamental mental models for investing. It refers to the idea that interest earned on an investment is reinvested and earns additional interest over time, leading to exponential growth in the investment’s value.

The Value of Diversification: Diversification is another essential mental model for investors. This mental model states that spreading your investments across multiple assets and sectors reduces the risk of significant losses in any one area.

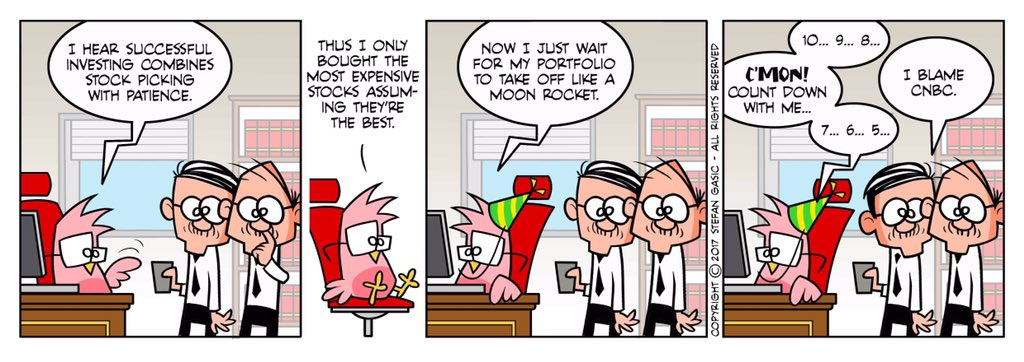

The Efficient Market Hypothesis: The Efficient Market Hypothesis (EMH) is a mental model that states that financial markets are “informationally efficient,” meaning that new information is quickly incorporated into prices and that it is impossible to consistently beat the market through informed trading.

The Margin of Safety: The Margin of Safety mental model is based on the idea that it’s better to be safe than sorry when investing. This model encourages investors to look for investments that offer a “margin of safety,” or a significant discount to their intrinsic value, to protect against potential losses.

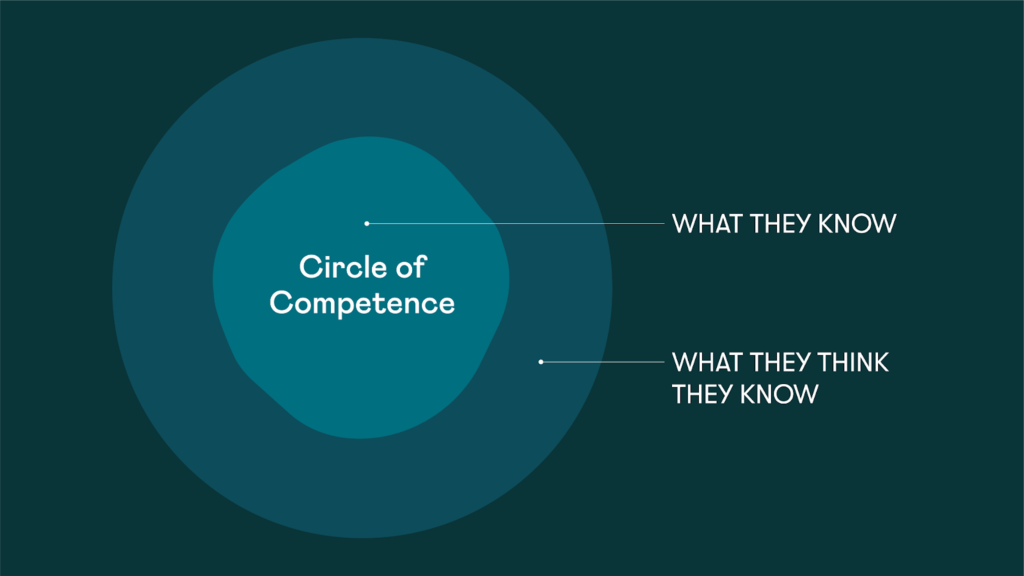

The Circle of Competence: The Circle of Competence is a mental model that encourages investors to focus their investments on areas that they understand and have expertise in. This mental model suggests that investors should limit their investments to industries and companies they understand, rather than attempting to invest in areas they have no knowledge or experience in.

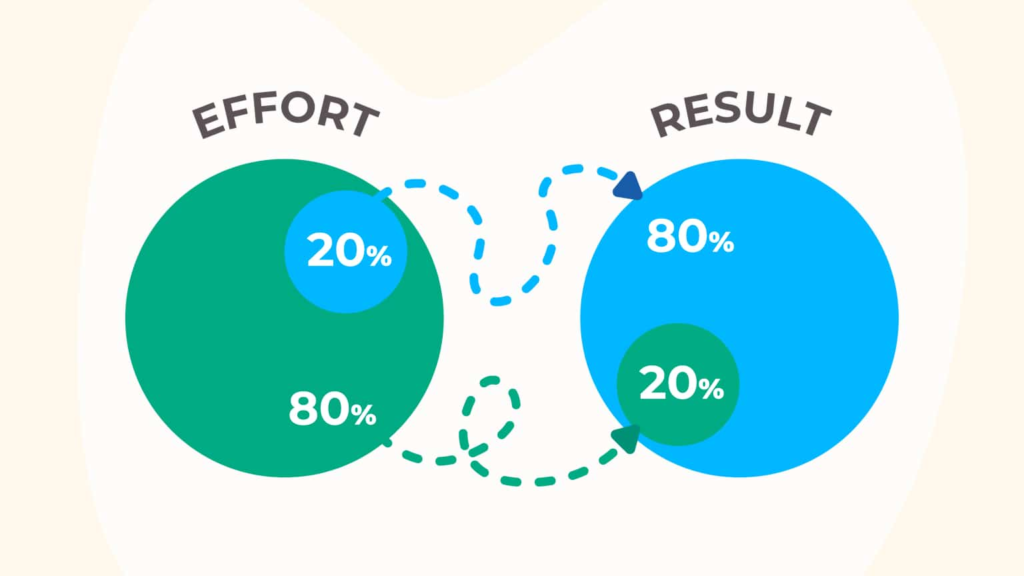

The Pareto Principle: The Pareto Principle, also known as the 80/20 rule, states that 80% of effects come from 20% of causes. In investing, this mental model can be applied to suggest that a small number of investments are likely to make up the majority of an investor’s returns.

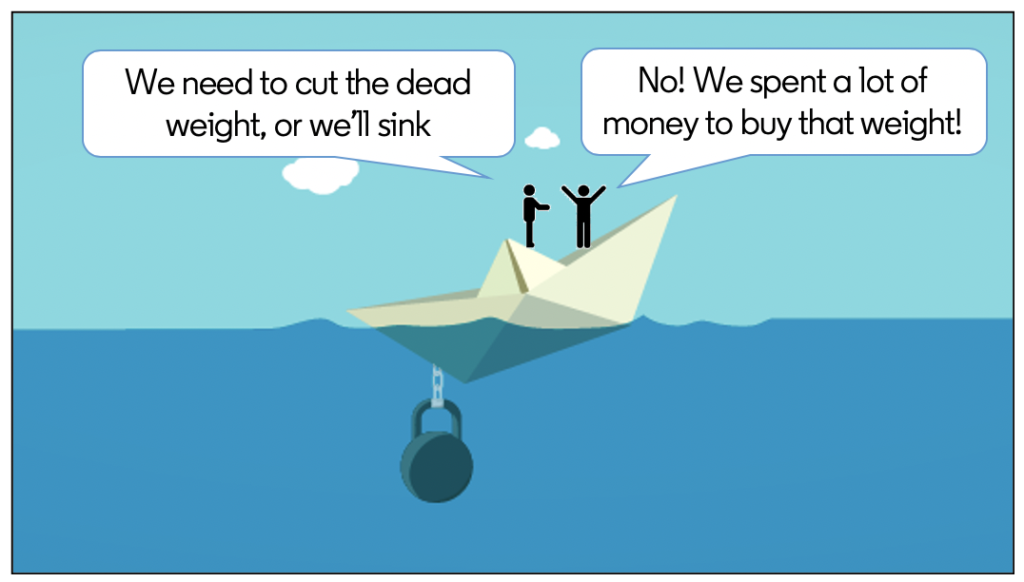

The Sunk Cost Fallacy: The Sunk Cost Fallacy is a mental model that refers to the tendency for people to continue to invest in a losing proposition because they have already invested time, money, or other resources into it. In investing, this mental model can lead to holding onto losing investments for too long, rather than cutting losses and moving on.

The Lollapalooza Effect: The Lollapalooza Effect is a useful mental model in investing. It refers to the idea that multiple factors or events can combine to drive a stock or asset’s price higher, creating a powerful and unsustainable rally.

The Regression to the Mean: The Regression to the Mean mental model states that extreme events tend to be followed by more average or normal events. In investing, this mental model can be applied to suggest that stocks that have performed exceptionally well in the past are likely to experience a pullback or correction in the future.

The Inverted U-Shaped Risk-Return Tradeoff: The Inverted U-Shaped Risk-Return Tradeoff mental model states that there is an inverse relationship between risk and return. In other words, as the level of risk in an investment increases, the potential for return also increases, but only up to a point. Beyond a certain level of risk, further increases in risk are likely to lead to a decrease in return.

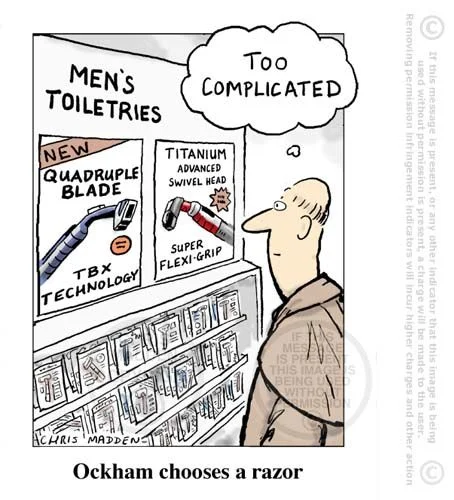

Occam’s Razor: Occam’s Razor is a mental model that states that, given multiple explanations for a phenomenon, the simplest explanation is most likely the correct one. In investing, Occam’s Razor can be applied to decision making by encouraging investors to look for the simplest explanation for a stock’s behavior, rather than overcomplicating the analysis.

The Poisson Distribution: The Poisson distribution is a statistical model that is often used in financial markets to model the occurrence of rare events. In investing, the Poisson distribution can be used to model the likelihood of events such as bankruptcy, default, or other extreme outcomes. By understanding the Poisson distribution, investors can make more informed decisions about the risks and potential rewards of different investments.

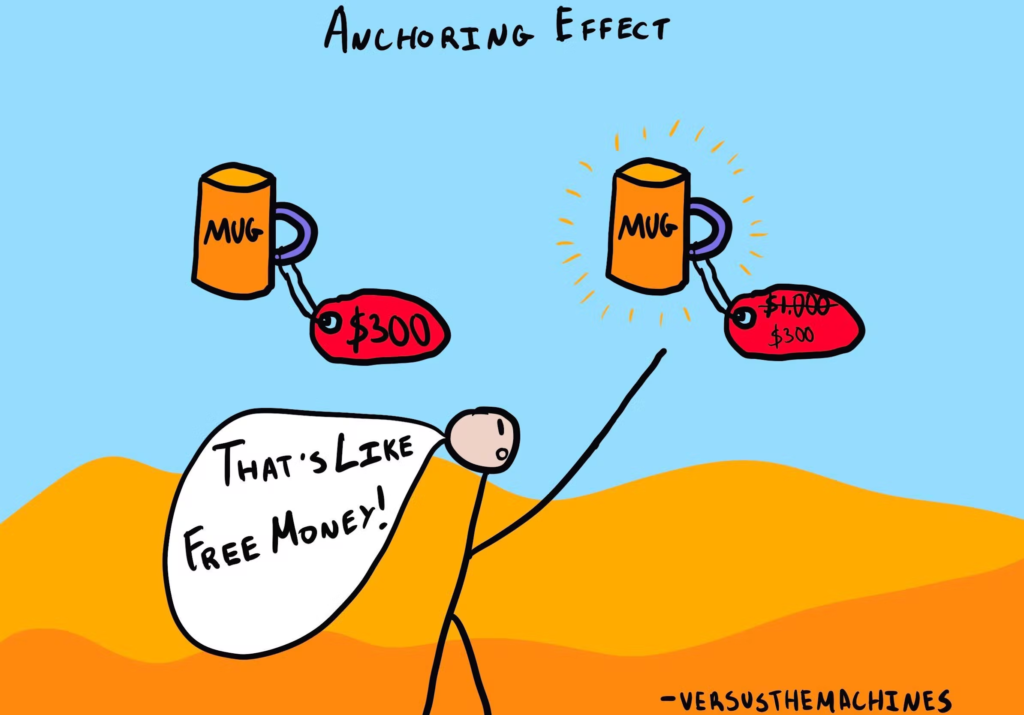

The Anchoring Bias: The Anchoring Bias is a mental model that refers to the tendency for people to rely too heavily on the first piece of information they receive when making decisions. In investing, the Anchoring Bias can lead to investors placing too much weight on a stock’s initial price or a company’s initial earnings reports, rather than considering all relevant information.

The Recency Bias: The Recency Bias is a mental model that refers to the tendency for people to place too much weight on recent events when making decisions. In investing, the Recency Bias can lead to investors overvaluing or undervaluing stocks based on recent performance, rather than considering a company’s long-term prospects.

The Availability Bias: The Availability Bias is a mental model that refers to the tendency for people to rely too heavily on readily available information when making decisions. In investing, the Availability Bias can lead to investors relying too heavily on news reports, analyst opinions, or stock prices, rather than considering other, more important factors.

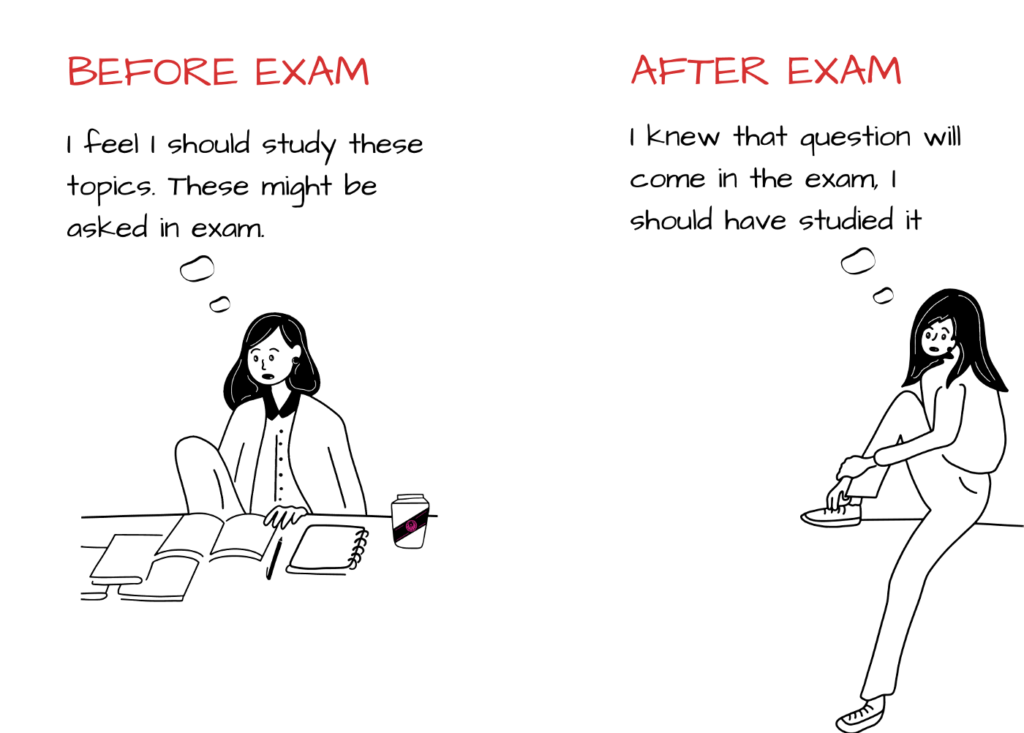

The Hindsight Bias: The Hindsight Bias is a mental model that refers to the tendency for people to view past events as being more predictable than they actually were. In investing, the Hindsight Bias can lead to investors believing that they could have seen a stock’s performance coming, even though the future is inherently uncertain.

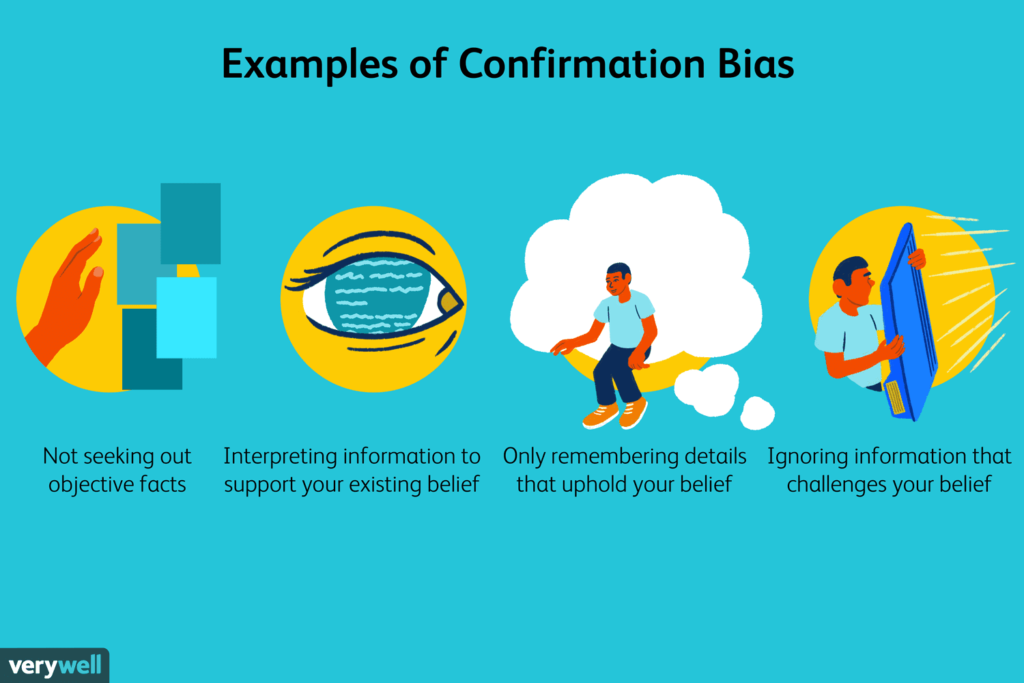

The Confirmation Bias: The Confirmation Bias is a mental model that refers to the tendency for people to seek out information that confirms their existing beliefs, while ignoring information that contradicts those beliefs. In investing, the Confirmation Bias can lead to investors placing too much weight on information that supports their investment thesis, rather than considering all relevant information.

The Mental Accounting Bias: The Mental Accounting Bias is a mental model that refers to the tendency for people to treat money differently based on its source or intended use. In investing, the Mental Accounting Bias can lead to investors treating their investments differently based on the source of the funds, rather than considering their overall portfolio.

The Framing Effect: The Framing Effect is a mental model that refers to the tendency for people to make different decisions based on how information is presented to them. In investing, the Framing Effect can lead to investors making different decisions based on the way information is presented, such as the format or language used in financial reports.

The Endowment Effect: The Endowment Effect is a mental model that refers to the tendency for people to place a higher value on items they own, compared to items they don’t own. In investing, the Endowment Effect can lead to investors holding onto losing investments for too long, because they feel a sense of ownership over the investment.

In conclusion, mental models are powerful tools for investors, helping them to make informed decisions, avoid common biases and mistakes, and understand the complexities of financial markets. By incorporating these mental models into their investment strategies, investors can increase their chances of success and achieve their financial goals.

Hope you learned few things about mental models. Please subscribe if you like to read more such posts.

Yours,

Goldforest Investments.

(Disclaimer- All imags are sourced from google search. Credit to creator. )

Leave a Reply